Discover our New Paperless Processing to Serve you Faster!

Our paperless loan process allows you to get access to the financial support you need faster. Applying for a paperless loan means you can get approved without having to print, sign and send all the paperwork. It’s as easy as that!

And don’t worry, paperless loans are safe and secure! We use 256-bit encryption bank level security to process your request and access a read-only copy of your bank statement. Paperless loans are simply the safest and most convenient way to be approved!

What are the Benefits of IBV?

Faster loan approval process

Safe & Secure

More Convenient

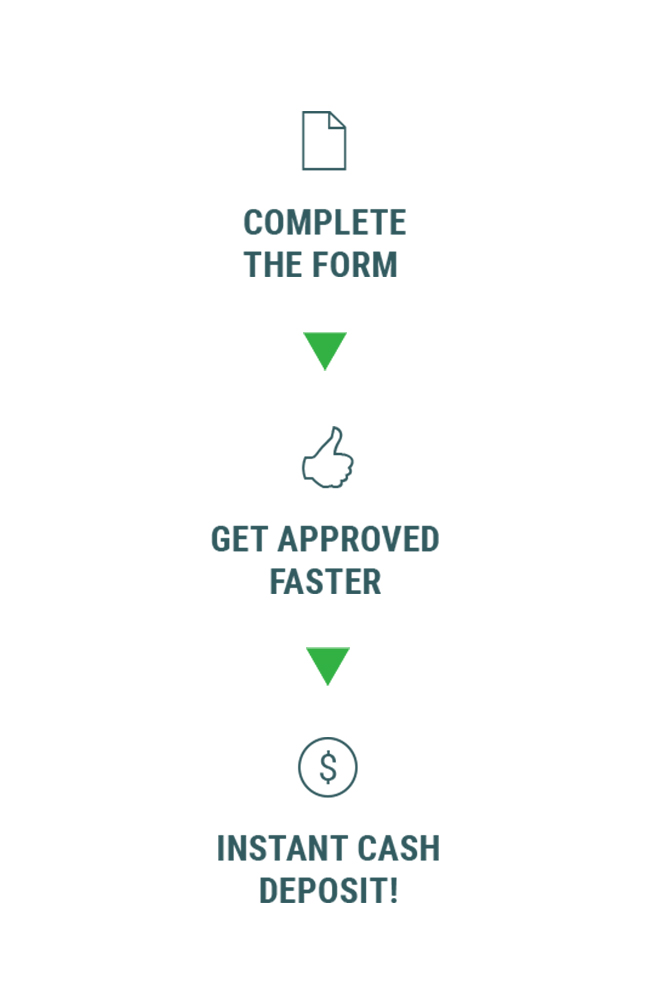

3 Easy Steps to Get your Money in the Next Hour

What is Instant Bank Verification (IBV)?

Instant Bank Verification is a simple process used between merchants and banking institutions to verify the online account or transaction of an individual initiating the request. In our case, the IBV process simply allows us to instantly verify your identity and view an electronic and secure copy of your bank statement to make a fast and accurate decision on your loan. It is important to note that none of your personal information is ever stored or used again once the verification is complete.

I don’t like giving my personal information online, how do I know if this is safe?

We understand your concern. This system was designed specifically to enhance your privacy and security. It operates at bank level security using the same 256‐bit encryption as your bank. Username and passwords are never displayed, view or stored. This is the safest, fastest, and most convenient way for you to submit your information for loan approval.

What will you do with my information?

Your user id and password are securely transferred to your financial institution in order to verify your identity as well as retrieve a 90 day “read‐ only” copy of your bank statement. The information is viewed by us in order to make a fast and accurate decision on your loan.

Are you going to be logging into my bank?

Absolutely not. We never see your user id and password nor do we ever have the option to “login” to your account. This system allows you to securely and privately submit an online read only copy of your bank statement. This information is necessary in order to approve your loan request and is the most secure technology on the market today.

Will you see my password information?

Never. Your ID and password are never displayed or viewed. Your credentials are transferred to your financial institution at bank level security. If your credentials are correct, we will then receive a “read‐only” copy of your bank statement allowing us to make a fast and accurate decision on your loan.

Why do I have to do this?

We use this system because it’s the safest & most convenient way for our customers to verify their banking information. This information is a necessary step in approving your loan request. It provides many benefits over old fashioned methods such as security, privacy and convenience, while greatly reducing the time spent.

What are the Interest Rates Every Year (Annual Interest Rates)?

We work with dependable financial institutions that offer 29% minimal and 32% maximum annual interest rates.

What Does a Typical Loan Look Like?

Let’s look at a typical loan together, ok? Let’s say you needed $750 in cash today. Our team would make sure you had that money in your account immediately after it was processed, usually the same day and sometimes even the same hour! Once you get your cash loan, you can repay over a flexible 3 to 6 month period. If for example you had borrowed $750 cash, you would pay us back in 10 installments of $120. For the purposes of this example we applied a $380 application fee that would be paid to the agent or broker. Again though, it is ultimately up to the official agent or broker to determine the fees that are applied to each file independent of the interest fees charged by the lender.

What Happens if I Default Payment?

There are two scenarios where a payment can be considered defaulted. The first scenario is where your pre-authorized payment bounces. If a payment to reimburse your loan bounces, we will charge a $50 NSF fee. Your financial institution may also charge you an additional NSF fee for a bounced payment, so it’s in your best interest to make sure payments are processed within your flexible repayment schedule.

The second scenario is where the payment isn’t necessarily defaulted; rather it’s deferred to a later date. If you have to repay your loan later than the date agreed upon when the loan was approved, there is an administration fee of $35.00 charged to the account. You should also make sure you inform us 3 business days before your payment date to ensure we can administer the payment date change in time.

Are There Other Conditions I Should Be Aware Of?

There are a few things that loan applicants should be aware of, one of which being that loans are not renewed unless you submit a request for another loan and we approve it. The other thing loan applicants should be aware of is that loan repayment terms vary from 3 months to 6 months as we mentioned above. That means that depending on how much money we loan you and the length of the payment schedule, the frequency and total amount of repayments can change.

What about Collections and Credit Scores?

Don’t worry, if a situation in your life interrupts your loan repayment schedule, our team will make sure that we modify your repayment agreement based on your current needs. However, as our company is in full legal compliance with Canadian lending regulations and standards, we have to demand full payment of any outstanding amounts, interests or costs if there is a default payment under a modified repayment agreement. Additionally if we incur any legal fees (judicial and extrajudicial) as a result of a default on your modified repayment agreement, we will claim these fees and ask you to repay us. If for some reason we cannot come to an agreement about your loan repayments, we will have no choice but to assign your file to a collection agency, which can negatively impact your credit rating. It is in your best interest to make sure your loan is paid back according to our repayment agreement or your modified repayment agreement.

*Your application has to be completed and approved before 3:30PM.